Travelling Allowance Rates

The Inland Revenue Departments (IRD) has an operational statement that relates to the tax-exempt portion of an amount paid to a Presbyter, an employee or other person. It is simply a way to calculate the reimbursement rates of expenditure incurred by the Presbyter, employee, or other person where that person uses their private motor vehicle for Church related travel.

Please note that in nearly all cases (there are limited exemptions to this general rule), travel between your home and place of work is considered private use and therefore the information set out here does not relate to that travel.

The IRD operational statement is reviewed from time to time. The contents of this part of the Information Leaflet have been updated to the current operational statement (OS 19/04B).

All references to “motor vehicles” and “vehicles” are referring to motor cars, vans, and tray-back vehicles such as coupe utilities no matter what capacity or engine size. The rates do not apply to motorcycles or scooters (petrol or electric).

It should be noted that by paying the reimbursement rates provided in this Information Leaflet, the IRD has confirmed that the amounts are tax free in the hands of the Presbyter, employee or person being reimbursed and meet the requirements of Section CW 17(3) of the Income Tax Act.

The kilometre rates are set by the Commissioner by reference to industry figures that represent the average cost of operating a motor vehicle. The various rates for selected vehicle types are made up of two tiers.

The Tier One rate is a combination of the vehicle’s fixed and running costs. The Tier One rate (orange column of the tables below) applies for the Church related portion of the first 14,000 kilometres travelled by the motor vehicle in a year. Beyond that the relevant Tier Two rate (blue column of the table), which is only the running costs, applies for the employment related portion of any travel more than 14,000 kilometres.

| Any person wishing to use the kilometre rate to calculate in the first table must maintain a logbook or be able to provide other evidence that establishes the Church use of the vehicle for an income year (tax year – 31 March is each year). |

-

Log Book Kept

The following are the rates per kilometre that apply from 1 July 2025 and assume a logbook IS being kept:

Kilometre Rates - with logbooks maintained

Vehicle Type Tier One Rates

(up to 14,000 km)Tier 2 Rates

(above 14,000 km)Petrol or Diesel $1.17 37 cents Diesel $1.26 35 cents Petrol Hybrid 86 cents 21 cents Electric $1.08 19 cents (Issues by IRD 10 June 2025)

The Commissioner’s kilometre rates are calculated on a GST inclusive basis. However, input tax cannot be claimed on the estimated allowances paid to reimburse an employee. GST input tax may only be claimed on an actual basis with the appropriate tax invoice being held at the time of claiming.

-

No Log Book Kept

In the absence of records as set out in the preceding paragraph, the use of the Tier One rates will be limited to the first 3,500km of business kilometres. The Tier Two rates will be used for the kilometres travelled for employment purposes above the 3,500 kilometre threshold.

Kilometre Rates - With no logbooks being maintained

Vehicle Type Tier One Rates

(up to 14,000 km)Tier 2 Rates

(above 14,000 km)Petrol $1.07 37 cents Diesel $1.26 35 cents Petrol Hybrid 86 cents 21 cents Electric $1.08 19 cents (Issues by IRD 10 June 2025)

The Commissioner’s kilometre rates are calculated on a GST inclusive basis. However, input tax cannot be claimed on the estimated allowances paid to reimburse an employee. GST input tax may only be claimed on an actual basis with the appropriate tax invoice being held at the time of claiming.

-

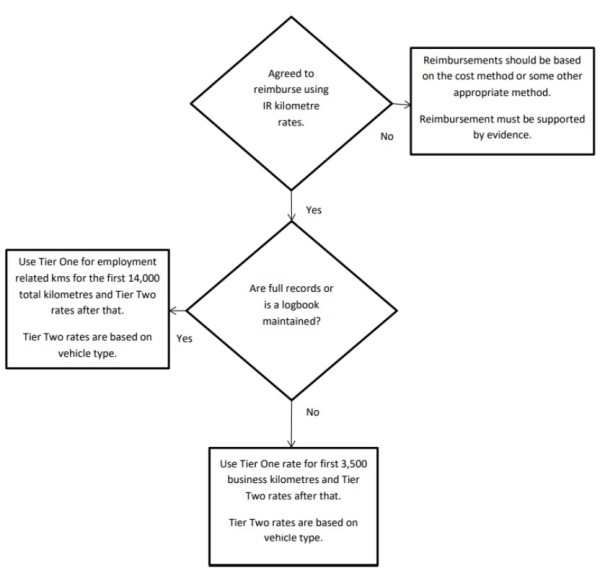

Flowchart for Mileage Reimbursement

-

Log Books

A Presbyter, employee or other person being reimbursed using the Commissioner’s kilometre rate should record their odometer reading every balance date (31 March each year) for each vehicle covered by the reimbursement so that they can determine whether a particular vehicle has travelled 14,000 kilometres (business and non-business) for the year. This is because the reimbursement for the kilometre rate method is based on a two-tier approach where the Tier One rate is only available for the first 14,000 total kilometres. Alternatively, in the case where no logbook is kept, the employer may treat any reimbursement after the first 3,500 kilometres (25%) at the tier two rate. Of course, a test period may establish a different percentage of employment related travel (refer example 3 below).

The Administration Division will supply logbooks free of charge to all Presbyters stationed by the Methodist Church. -

Example One - Single Journey - No Log Book

The following are examples using the kilometre rate method to calculate reimbursement.

The Presbyter or Employee used their private vehicle for a single 65km journey for their Church related work and did not maintain a logbook.

They are entitled to treat any reimbursement as tax-free for the first 3,500 km of Church related kilometres at the Tier One rate.

The Church must keep a record of how many Church related kilometres are travelled in the income year (for that vehicle) because any kilometres over 3,500 will only be tax-free calculated at the Tier Two rate.

The calculation (assuming the 3,500 km figure was not breached) would be:

65km x $1.07 (the Tier One rate) = $69.55 tax free reimbursement

-

Example Two - Regular Journey - No Log Book

The Presbyter or Employee used their private vehicle, a petrol-powered motor vehicle, for a regular 65km journey for their Church related work and did not maintain a logbook.

They are entitled to treat any reimbursement as tax-free for the first 3,500 Church related kilometres at the Tier One rate.

The Church must keep a record of how many Church related kilometres are travelled in the income year (for that vehicle) because any kilometres over 3,500 will only be tax-free calculated at the Tier Two rate.

The calculation (assuming the 3,500 km figure was breached two months earlier) would be:

65km x 37 cents (the Tier 2 rate) = $24.05 tax free reimbursement

-

Example Three - Regular Journey - Trial Log Book

The Presbyter or Employee used their private vehicle, a petrol hybrid-powered motor vehicle, for a regular 65km journey for their employment and did maintain a logbook (albeit for a three-month trial period).

The Presbyters or employee’s logbook evidences that the vehicle is used 40% for Church related purposes and 60% for private/other use.

They are entitled to treat any reimbursement as tax-free for the first 40% of the vehicles total kilometres up to the first 14,000 at the Tier One rate.

The Presbyter or employee must notify the employer when the annual kilometres reaches 14,000. This is because any kilometres from that point on will only be tax-free calculated at the Tier Two rate.

Alternatively, the employer could keep a record of the employment kilometres and use the Tier Two calculation once the claim reached 5,600 kilometres (40% of 14,000). Using this alternative approach will mean that the employee will not need to keep any records beyond the three-month trial logbook period.

The calculation (assuming the 5,600 km figure was breached two months earlier) would be:

65km x 21 cents (the Tier Two rate) = $13.65 tax free reimbursement.